See beyond, invest with AI

Clients & partners

Who we serve

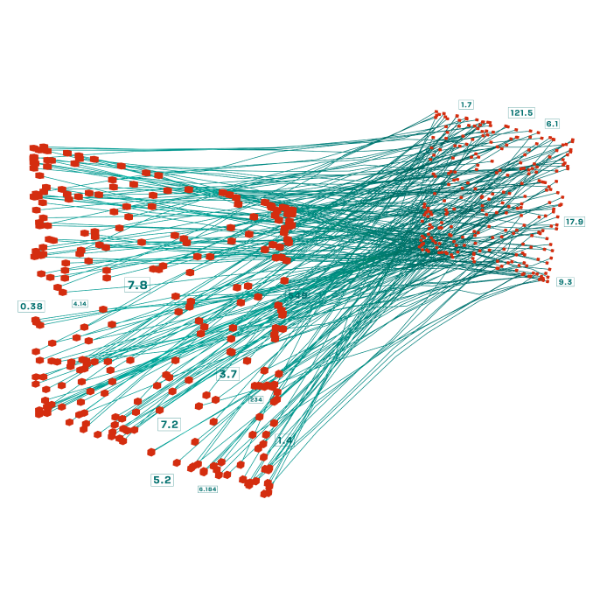

Turn data into insights

Investment professionals face the challenge of deciphering ever-growing, complex datasets for strategic decision-making. Traditional analytical methods struggle to match the pace of evolving market dynamics. aisot's no-code AI Insights Platform empowers professional investors to quickly adjust strategies, efficiently synthesizing essential data—from market trends to social media insights and macroeconomic indicators. By analyzing millions of data points in real time, the aisot AI Insights Platform ensures superior outcomes through a focused lens on more relevant data sources.

400M

News articles screened to train models

53%

Up to 53% better forecasts of 1-hour realized volatility than the baseline

80%

Achieving up to an 80% improvement over baselines through the adoption of Interpretable Multi-Variable Long Short-Term Memory (IMV-LSTM) networks

The new era of asset management: AI Insights Platform

aisot's proprietary AI platform allows investment managers to generate portfolios that can not only reflect customer preferences in stock and cryptocurrency markets at any given time but also optimize investment decisions through AI and issue them as fully automated financial products.

AI Insights Dashboard

Statistical tool suite, enabling users to perform in-depth analysis and evaluate the performance of their portfolios.

Custom Features

Providing valuable insights on market sentiment to help investors make informed decisions.

Accelerations and recognitions

AI technology developed for asset management: aisot labs

aisot's artificial intelligence engine is built on the years of experience of our team in machine learning, deep learning, quant finance and natural language processing. Starting with market data (stocks, indices etc.), and expanding to alternative data (blogs, social media etc.) and macroeconomic data, the aisot AI engine combines millions of data points to extract better results from less but relevant data sources.