ML10: October Update

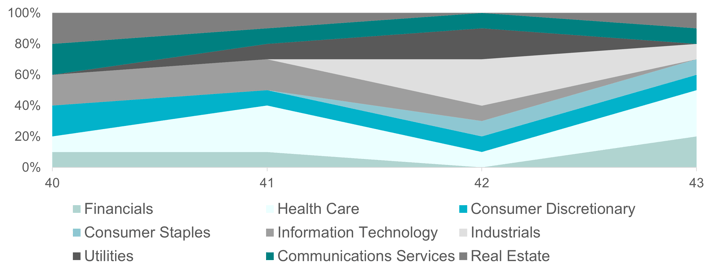

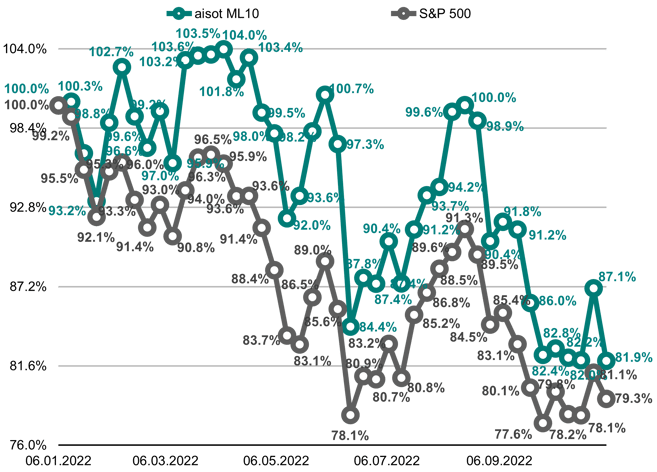

In the month of October 2022, aisot ML10 had a performance of +9.5%, compared with +8% of the S&P 500. Overall, the ML10 portfolio was balanced in October across nine sectors between with a slight overweight in Health Care. Last month, we also introduced a sector risk overlay, preventing strong sector concentration.

The longest holding has been Lumen (LUMN) which has been held for the entire month. The best trade of the month was Carnival (CCL) with +14.6% between October 7 and October 21.

Sector risk overlay

As a new feature of the aisot ML10 designed to lower volatility and diversify sector exposure, we introduced a sector risk overlay. At our rebalancing on October 7, 2022, the sector risk overlay automatically exchanged two titles in our top 10 list:

- DTE Energy (DTE) and Pinnacle West Capital (PNW) were excluded and replaced by Vornado Realty Trust (VNO) and CME Group (CME)

- DTE and PNW made an average of -2.4% that week; VNO and CME made -1.5%

- Overall our performance that week was -0.8% while S&P was -2%

About aisot ML10

On January 7, 2022, aisot went live with ML10, a portfolio that trades S&P 500 stocks. During a weekly rebalancing on Fridays, aisot's fully automated AI engine gathers all new data points, retrains the models, selects the top 10 ranked stocks by our machine learning model, and allocates an equal dollar amount to each.

November 3, 2022, market close

DISCLAIMER

This document was prepared by Aisot Technologies AG for information and marketing purposes. However, Aisot Technologies makes no representation or warranty with respect to its contents or completeness and disclaims any liability for loss or damage of any kind incurred directly or indirectly through the use of this document or the information contained herein. All opinions expressed in this document are those of Aisot Technologies at the time of writing and are subject to change without prior notice. Unless otherwise stated, all figures are unaudited. This document is for the information of the recipient only and does not constitute investment advice, an offer or a recommendation to purchase financial instruments and does not release the recipient from his or her own evaluation and judgement. This document is explicitly not intended for persons whose nationality, place of residence or other characteristics prohibit access to such information due to applicable legislation.

Every investment involves risks, particularly those of fluctuations in value and income. Collective investments are volatile and an investment may result in the total loss of the capital invested. Furthermore, performance data does not account for the commissions and costs that may be charged on issue and/or redemption. Furthermore, it cannot be guaranteed that the performance of comparable indices will be achieved or exceeded. A positive performance in the past or the indication of such a performance is no guarantee for a positive performance in the future. Investments in foreign currencies may be subject to currency fluctuations. There is an additional risk that the foreign currency may lose value against the investor's reference currency.