Outperforming the benchmarks: aisot’s equity portfolio products

Everyone wants to know what’s to come—right? Even more so investment managers. Leveraging the power of artificial intelligence is not a crystal ball, but making efficient use of the large amounts of data available can help investment managers to know a bit better what’s to come and reduce potential losses and uncertainty.

Until recently, quant and artificial intelligence investment products and tools were out of reach for most boutique and smaller investment firms. Research by Chartered Financial Analyst (CFA) Institute shows that less than 10% of portfolio managers were using artificial intelligence technologies in 2019, with most managers still using spreadsheet-based tools. While this number might not be much higher today, aisot is part of a democratization process of the industry, bringing access to sophisticated technologies and artificial intelligence to a wide range of investors across different asset classes. The goal of artificial intelligence is not to replace portfolio managers but to give them the tool to make sense out of fast-paced markets and reduce risk and uncertainty.

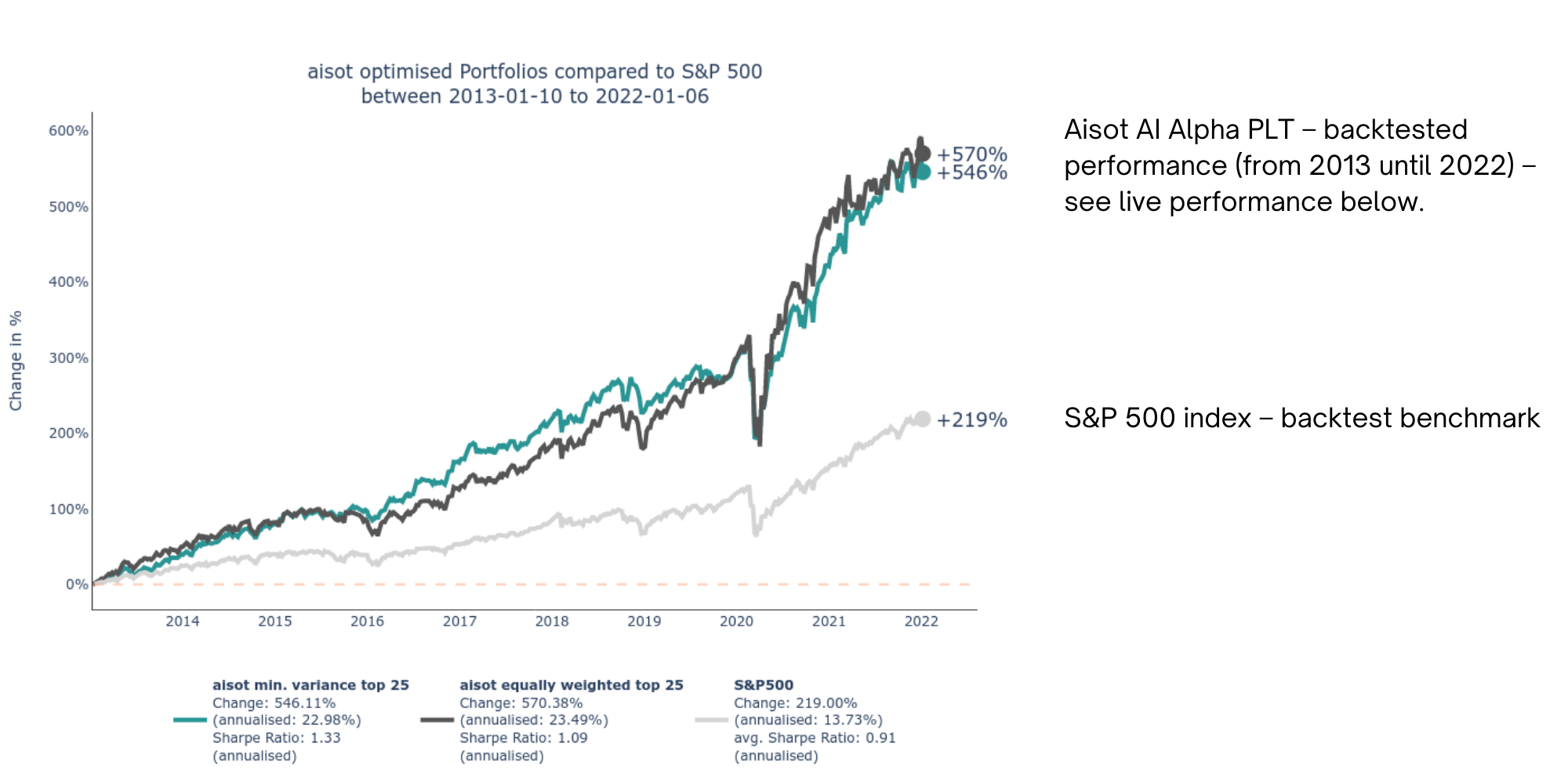

Looking at the process of creating a financial product, there are basic procedures such as a fund manager creating a management product and a trader operating it. Humans are great in some areas, e.g. creativity or communication, but in other areas such as finding statistically valid patterns in data or data processing artificial intelligence is doing a better job. While artificial intelligence can be applied in many different ways in the process of optimizing portfolios, an increase of the performance of a portfolio is the single most important outcome.aisot’s central artificial intelligence engine, the aisot AI Alpha PLT, is built on the years of experience of our team in machine learning, deep learning, quant finance and natural language processing, which makes it technologically one of the most advanced products on the market. aisot’s platform bridges the efficiency and talent gap for asset managers and beyond. In the last few months, aisot has developed and tested a Machine Learning driven long-only portfolio of 25 titles of the S&P 500. Optimized weekly, the backtesting results indicate that all of our strategies outperform the market by factor 2 or more. See chart below.

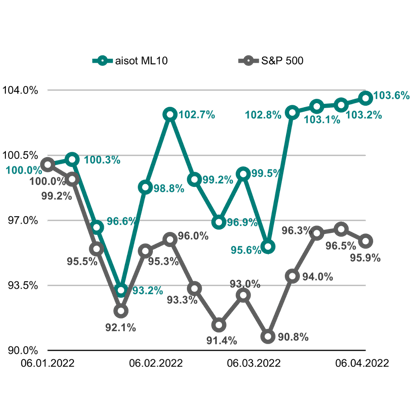

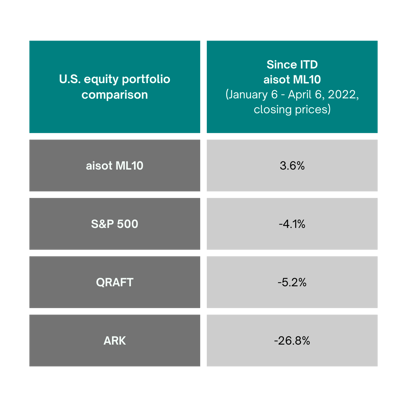

In the last few weeks, aisot has live-tested the Machine Learning driven long-only portfolio as a subset of 10 titles of the S&P 500, that is re-balanced on a weekly scale. We track the portfolio virtually and by trading it on a real-money account. The portfolio has so far shown a stable outperformance over a range of benchmarks as shown below.